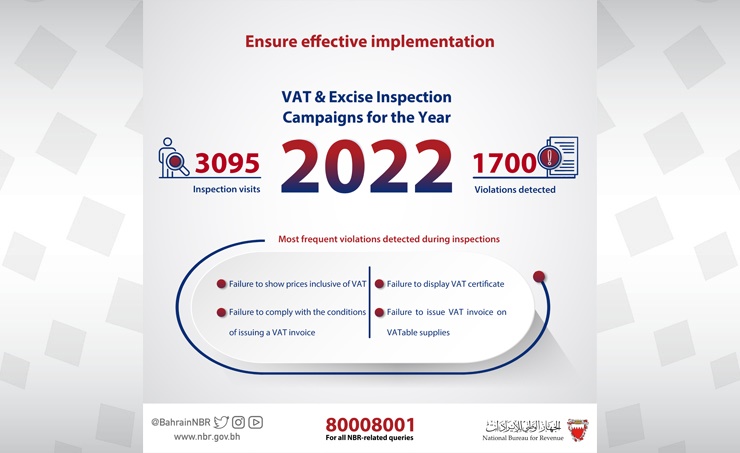

Manama : The National Bureau for Revenue (NBR), in cooperation with the concerned entities has conducted more than 3,000 inspection visits within the local markets of the governorates of the Kingdom of Bahrain during the last year of 2022.

The campaigns resulted in reporting 1,700 violations that required the imposition of administrative fines in accordance with the VAT & Excise Law. In addition to monitoring several suspicions of VAT and excise evasion that required the precautionary closing of several businesses.

Accordingly, the NBR has taken legal action against the violating businesses, and referred those who are proven to have committed one of the evasion crimes to the competent authorities to initiate a criminal case against them, which may be punishable by imprisonment for five years and a fine equivalent to three times the amount of VAT due according to the VAT law, or by imprisonment for one year and a fine equivalent to double the evaded excise according to the Excise law.

These campaigns were organised as a part of NBR’s ongoing oversight efforts to protect consumer rights and enhance the level of business compliance, commitment to strengthen control over local markets to ensure the effective implementation of VAT and excise, which includes the implementation of the Digital Stamps Scheme on cigarette products to guarantee that businesses are aware of the Scheme and the mandatory presence of digital stamps on all cigarette products available in the local markets, in addition to spread the necessary awareness of the procedures to be pursued.

These efforts come as part of the regular inspection and control procedures that are carried out using the cutting-edge tools and latest field electronic mechanisms adopted by the NBR during inspections, that contributes to tightening control over local markets, addressing tax evasion, and preventing the possession, trade, sale, or supply of products that have not fulfilled their VAT or excise obligations, which includes the Digital Stamps Scheme on cigarette products in the local markets entered into force on October 16, 2022.

The NBR also confirmed the continuation of inspection campaigns in cooperation with the concerned entities aiming to urge all businesses registered with the NBR to adhere to the application of legislation to prevent violations and to ensure the success of the various stages of implementation.

For inquiries related to VAT and excise or to report any violations, the NBR call center can be reached at 80008001 available 24 hours, 7 days a week, or through the National Suggestions & Complaints System (Tawasul), vat@nbr.gov.bh for VAT related queries and ds@nbr.gov.bh for Digital Stamps Scheme queries.